Futures Trading Uk Tax

However if you are doing this as an investor then the income or gains should be declared for Capital gains purposes. If you have got to the stage of needing an accountant you may be better off changing clearers.

Look at Algorithmic Trading and Clearing House for Futures Forex Equities and Options Traders they are offering tax free futures trading using professional front ends.

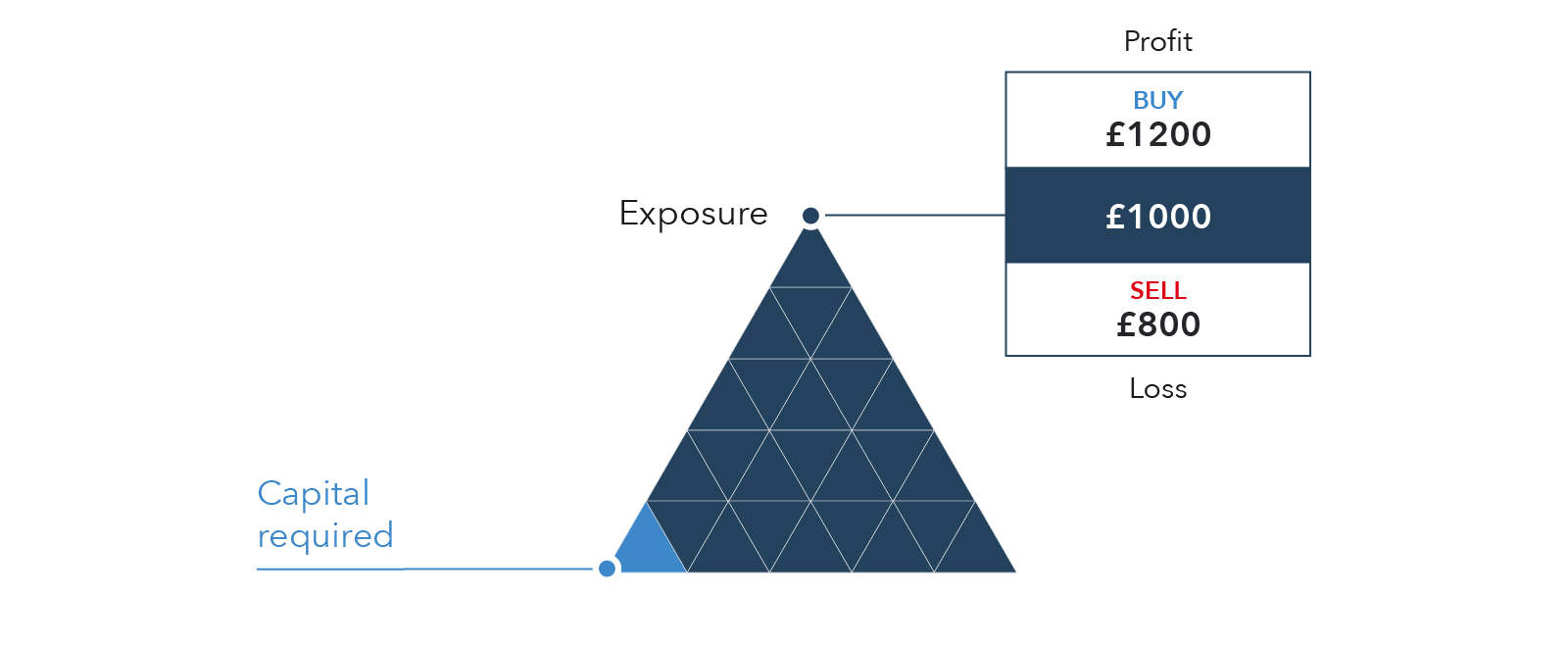

Futures trading uk tax. Capital gains and losses from futures trading are automatically split into 60 percent long term gains and 40 percent short term gains. This guide is for sole traders and those who do trading as a side gig to their full time employment. Whether you are day trading CFDs bitcoin stocks futures or forex there is a distinct lack of clarity as to how taxes on losses and profits should be applied.

As the value of the underlying asset moves he or she may. The investor will have to put up a deposit commonly 20 of the value of the underlying asset although it may range from about 5 to 35. Profits from transactions in commodity and financial futures dealt in on a futures exchange which is not recognised will be liable to tax as income if the transactions do not amount to trading.

Stamp Duty Reserve Tax a tax or duty that you pay when you buy shares. I live in UK and I see that there are 2 taxes when trading. Tax-deductible losses are useful for hedging 3 Trade with leverage open a position with a deposit with losses and profits calculated on the full trade size.

Forex trading uk tax implications Miss Cumbria an. Enjoy 55 assets and free market strategies. In this example on line 8 of Form 6781 you would multiply 5000 x 40 2000.

We make financial markets clear for everyone. We make financial markets clear for everyone. - CGT to be paid on capital gain and is 18 or 28 depending if you are basic tax payer or not.

Choosing capital gains and losses reporting with futures trading has a significant income tax rate advantage. Ad Make your first steps on financial markets. Best trading app as awarded at the advfn international financial awards 2020.

Your securities trades are taxed as short-term capital gains at the ordinary income tax rate of up to 35. However tax laws are subject to change and depend on individual circumstances. However with day trading promising an enticing lifestyle and significant profit potential you shouldnt let the UKs obscure tax rules deter you.

Securities futures capital gainslosses are reported either on Schedule D Capital Gains and Losses or as ordinary capital gainslosses on IRS Form 4797 Part II Sales of Business Property if you elected mark-to-market accounting. If forex trading is a side gig you are covered by the Trading Allowance. F O transactions are one such transaction.

Make a forecast and see the result in 1 minute. The issue is further complicated when it is reviewed. Capital Gains Tax tax that you pay on your profits from selling assets.

Profits are tax-free in the UK 3 Trade with leverage open a position with a deposit with losses and profits calculated on the full trade size. Please seek independent advice if necessary. Posted 12 months ago by HMRC Admin 5.

UK trading taxes are a minefield. Retail contracts for differences are financial futures and unless the profits are taxable as trading income in almost every case. This means that 60 of their income from futures trading will be taxed at 15 rather than their typical tax bracket rate.

- income tax on any interest or dividend received. Long-term capital gains are capped at 15 which is much more favorable to those with higher incomes. Spread betting is also exempt from UK Capital Gains Tax.

Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms Forex Trading Uk Taxes and unlike government-issued currencies it is operated by a decentralized authority. On line 9 you would multiply 5000 x 60 3000. Follow lines 8 and 9 and calculate your capital gains.

If you are doing this as a business or trade then the income will be declared as self employment. Ad Make your first steps on financial markets. Trading is a side gig.

Forex Trading Uk Taxes Satoshi Nakamoto. Futures Options FO trading Income tax return. 1 The identity of the person or persons who created the technology is still a mystery.

Make a forecast and see the result in 1 minute. 1 point spreads available on the UK 100 Germany 30 France 40 and Australia 200 during market hours on daily funded trades and CFDs excluding futures. Enjoy 55 assets and free market strategies.

It mentions the below. Confusion prevails as far as return filing is concerned if the person is dealing in future options. Forex trading involves significant risk of loss and is not suitable for all investors.

Forex Trading Uk Tax Forex Trading Uk Tax. Some transactions are easy to execute but difficult to comply while filing the income tax return. It will depend on the how you are day trading.

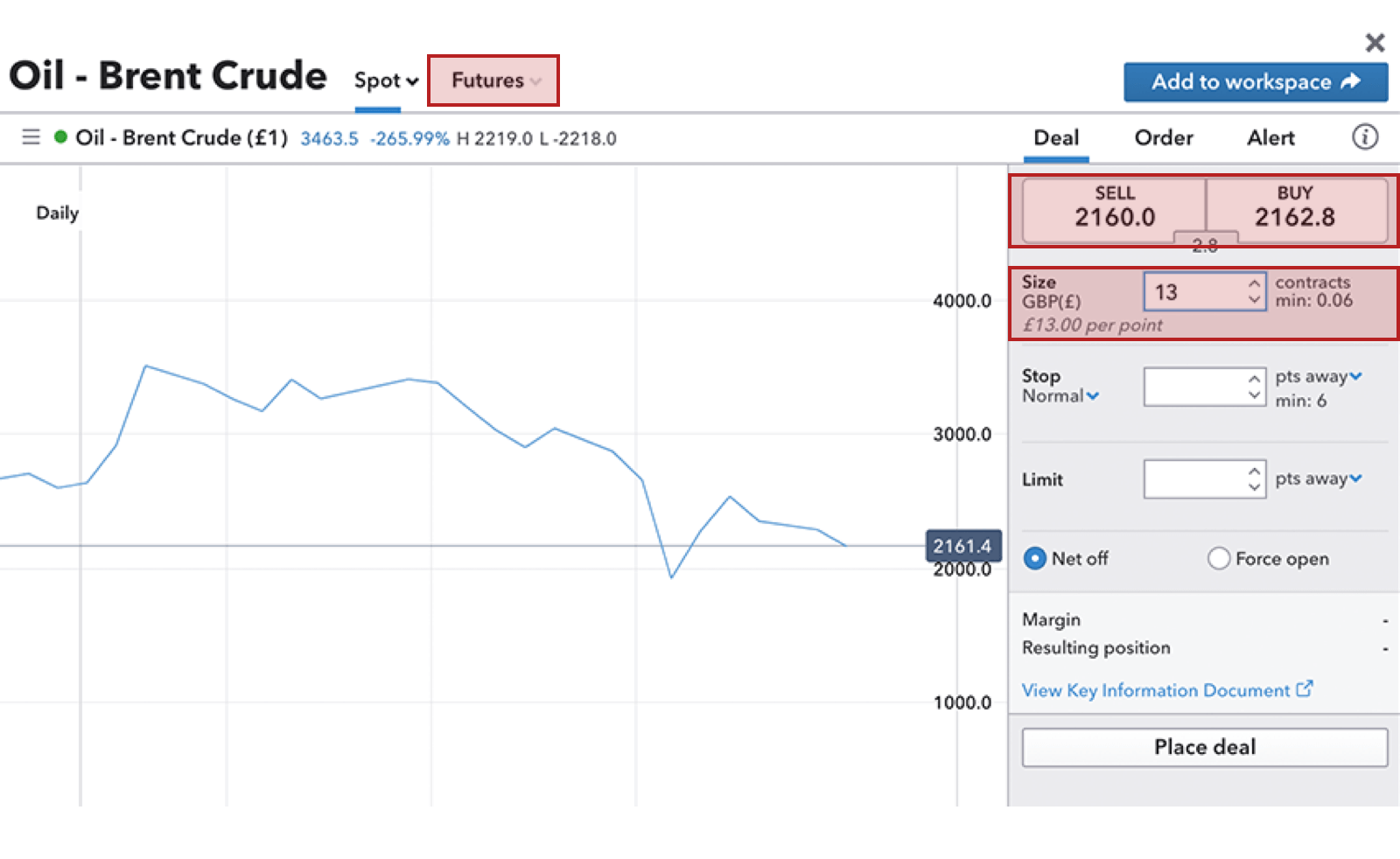

Oil Trading How To Buy And Invest In Crude Oil Ig Uk

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

3 Tax Advantages Of Micro E Mini Futures Trading Ninjatrader Blog

Day Trading Taxes How Profits On Trading Are Taxed

Download Channel Breakout Entry Best Free Forex Indicator Mt4 Forex Forex Trading Forex Trading Tips

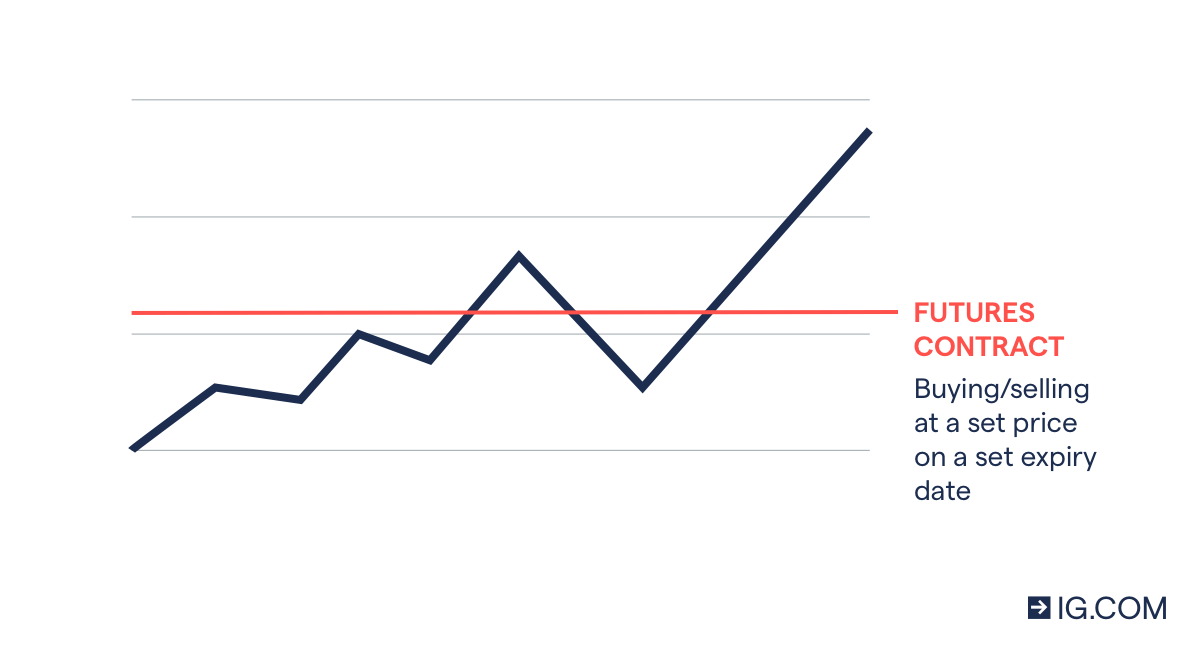

What Is Futures Trading How To Trade Futures Ig South Africa

Types Of Trade Day Trading Short Long Term Trading City Index Uk

Trading Futures Other Section 1256 Contracts Has Tax Advantages

What Is Futures Trading How To Trade Futures Ig South Africa

Uk Carbon Price Trades At 50 As Market Opens For First Time Financial Times

Futures Trading Trade Index Futures In Uk On Tickmill Co Uk Tickmill

Futures Trading Trade Index Futures In Uk On Tickmill Co Uk Tickmill

Futures Trading Trade Index Futures In Uk On Tickmill Co Uk Tickmill

3 Tax Advantages Of Micro E Mini Futures Trading Ninjatrader Blog

Pdf Would A Financial Transaction Tax Affect Financial Market Activity Insights From Future Markets

Futures Trading Trade Index Futures In Uk On Tickmill Co Uk Tickmill