Usdts-m Futures Trading Fee Rate

Profits are multiplied if the market moves in your favour. B Brent Crude Futures 084 015 059 099 129 198 238 268 2000 G Gas Oil Futures 084 015 059 099 129 198 238 268 2000 T WTI Crude Futures 084 015 059 099 129 198 238 268 2000 Trading foreign exchanges may include additional charges which are.

Ethereum 2 0 Contract Reaches 100 000 Eth Milestone

Your account will be charged until you either close your account resume trading or the balance on your account is reduced to zero inactive accounts will not incur a negative balance.

Usdts-m futures trading fee rate. Use our Futures Calculator to quickly establish your potential profit or loss on a futures trade. These fees vary substantially between full service and discount brokers. 500 1000.

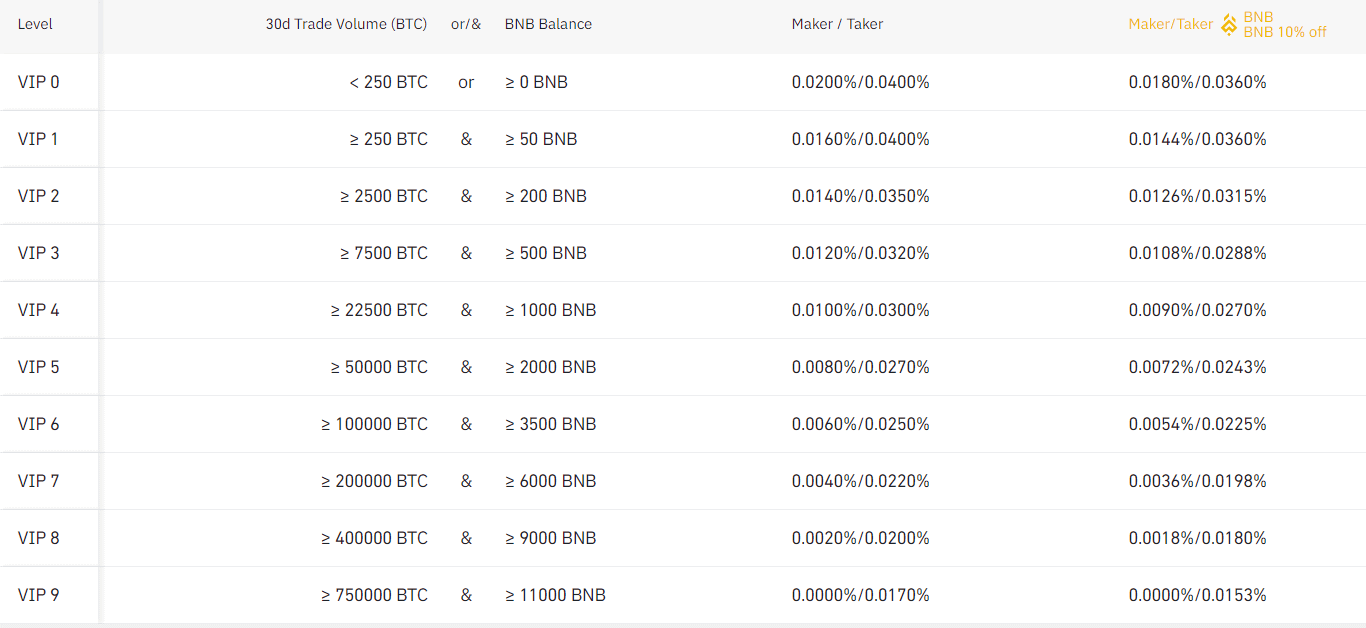

For example VIP 0 marker commission. Lets say youve transferred 1000 USDT to your USDT-M futures wallet and will open a long or short position with 5x leverage. Position size entryclose price 100 fee rate For example if youve opened a 05 BTC position at 32000 USDT.

After filling youll pay the maker fee and another user will pay the taker fee. In addition how fees are calculated varies. Instead its posted to the order book so other users can fill it.

30-day Trading BTC Maker Fee. Fee Rate for Type III Currency. So if your trading volume is below 250 BTC youll be charged a 002 or 004 trading fee when you open and close positions.

Commission fee notional value x fee rate. Unlike the usual futures contracts they also allow you to hold positions without an expiry date for the contract. Buy 10 BTCUSD 0925 quarterly contract using Market order.

CBOE Volatility Index Vix E. Binance futures offers Perpetual futures contract to trade as well. The primary costs involved in futures trading are brokerage fees.

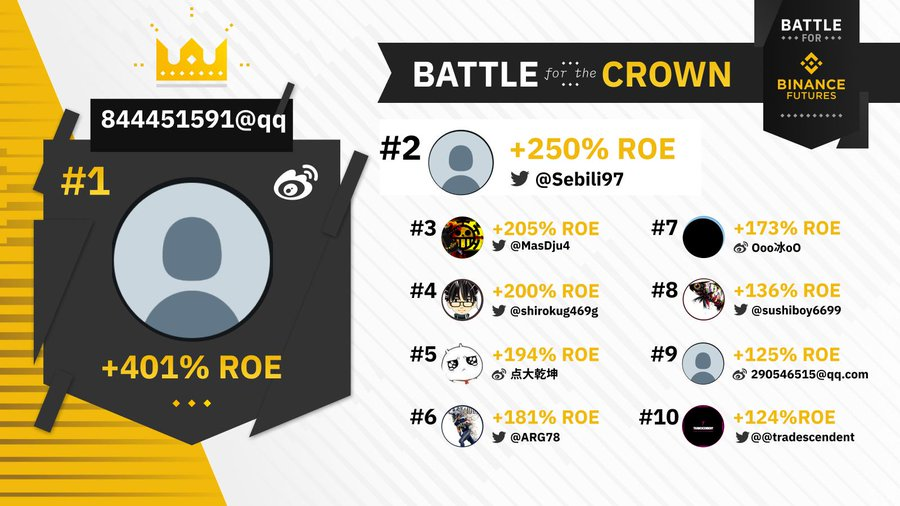

The USDs-M Futures fees depending on your trade volume in the last 30 days can be seen in the image below. Of the three t-note types the most commonly quoted and. 24hr Withdrawal Limit BTC 30-day Trading BTC Maker Fee.

How to calculate Binance Futures fees. Enjoy more benefits with BNB fee deductions for the following transactions. Log in to check your trading fee rate.

While not a fee that is charged by Kraken Futures positions opened in Perpetual contracts will accumulate a funding rate as an unrealised profitloss UPL which settles every 4 hours at end of the funding period or when you change your net open position whichever occurs first. 30-day Trading BTC Maker Fee. Why should you trade Futures.

With the USDT-Margined futures the contracts are settled in the stablecoin USDT a cryptocurrency that holds the same value as the USD so 1 USDT 1 USD. Every month a coupon payment is made for the t-notes until the maturity year is reached. This easy-to-use tool can be used to help you figure out what you could potentially make or lose on a trade or determine where to place a protective stop-loss orderlimit order to capture your profit.

You buy 1 lot of MSCI Singapore Stock Index Futures valued at 30000. Fee Summary Guide 4 Agricultural Products CME Agricultural Products Futures and Options fees Membership Type EXCHANGE FEE Clearing Members and Equity Member Firms 1 Open Auction 015 Electronic 051 Trading Member Firms 106H Open Auction 049 Electronic 081 Electronic Corporate Members ECMs Open Auction 069 Electronic 081 International Incentive Program IIP Open. Treasury notes or t-notes are purchased at a price below the denomination of 1000 and mature via accumulated interest to the designated amount in either 1 5 or 10 years.

For example if your account is in USD you will be charged 10 USD. Lv1. Futures contracts are leveraged.

10-Yr Interest Rate Swap. The final fee cant exceed 125 of the option premium. As a futures trader it is critical to understand exactly what your potential risk and reward will be in monetary terms on any given trade.

Notional value number of contracts x contract size opening price. Read tips for how to use the futures. Your initial margin required is only 2090.

Investors can trade large contracts at just the fraction of the cost making it a cost-efficient instrument eg. Notional value number of contracts x contract size trade price.

Ethereum 2 0 Contract Reaches 100 000 Eth Milestone

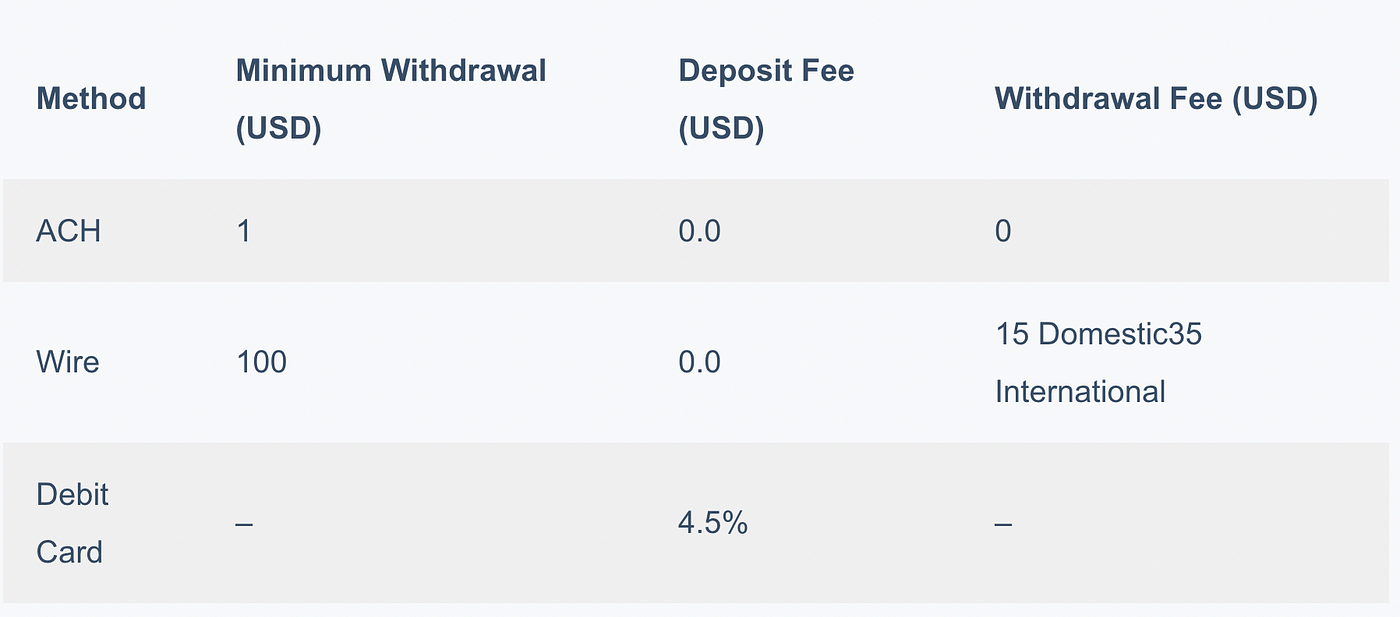

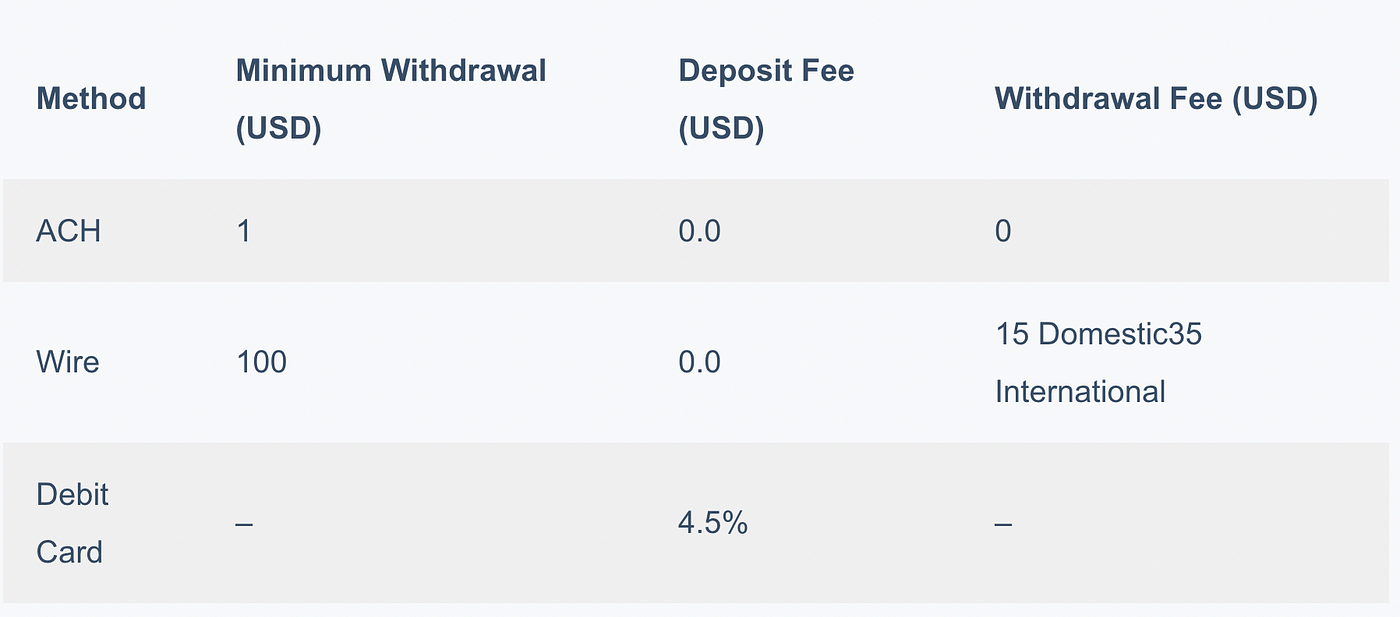

Binance Fees 2021 Complete Guide For Binance And Binance Us Coinmonks

Ethereum 2 0 Contract Reaches 100 000 Eth Milestone

Binance Fees 2021 Complete Guide For Binance And Binance Us Coinmonks

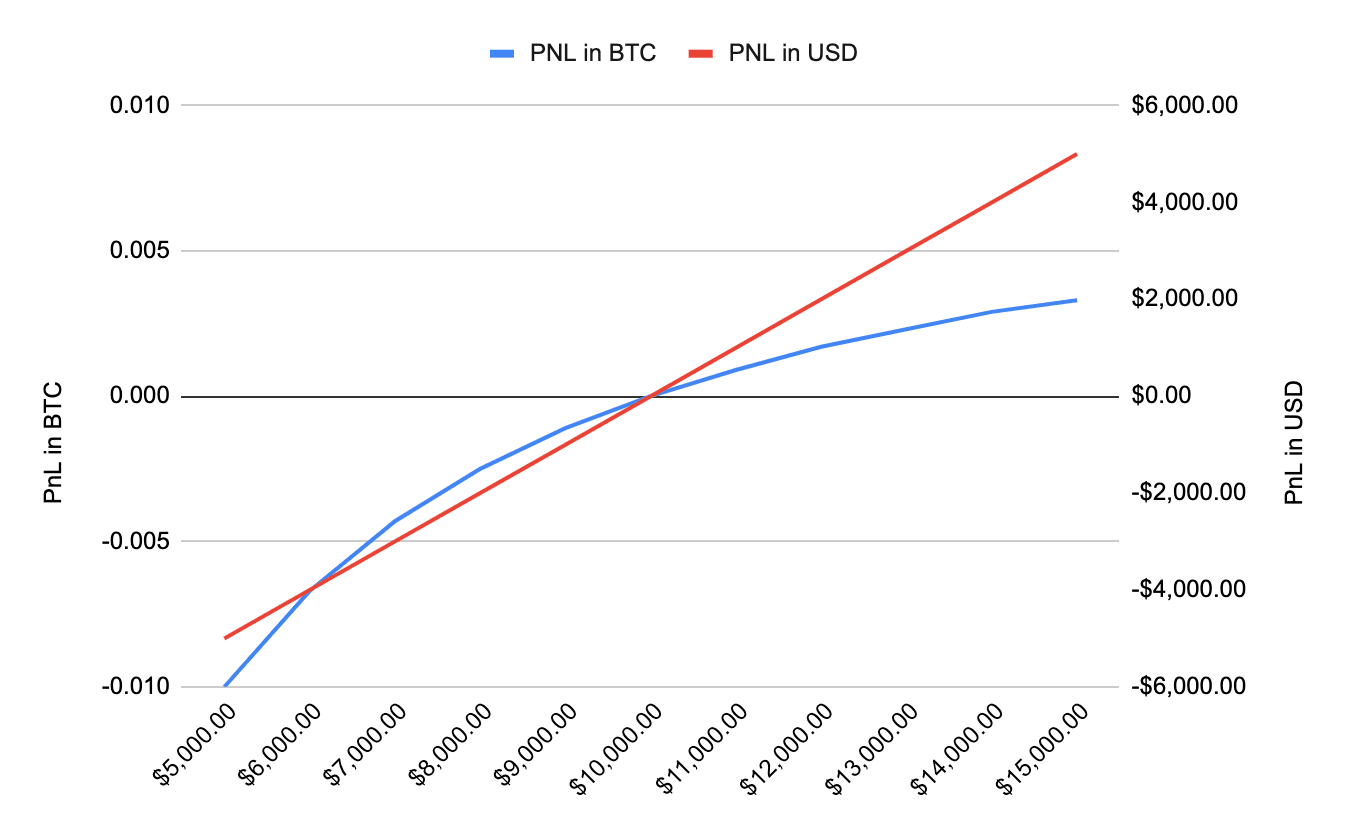

The Pros And Cons Of Coin Usdt Margined Contracts How Do They Impact Your Returns Binance Blog

Binance Weekly Report All About That Busd Binance Blog

A Beginner S Guide For Pinoys On How Staking Works Blog Ng Binance

Binance Weekly Report All About That Busd Binance Blog

Binance Weekly Report All About That Busd Binance Blog

Binance Fees 2021 Complete Guide For Binance And Binance Us Coinmonks

Neteller Updates Crypto Features For Their Online Payments Platform

Binance Fees 2021 Complete Guide For Binance And Binance Us Coinmonks

The Pros And Cons Of Coin Usdt Margined Contracts How Do They Impact Your Returns Binance Blog

Binance How To Transfer From P2p Wallet To Your Spot Wallet Youtube

News Bitcoin Deltaexchange Futurescontracts Tether Delta Exchange Announces Futures Contracts Of Bitcoin Tether Tether Cryptocurrency Trading Bitcoin

Binance Fees 2021 Complete Guide For Binance And Binance Us Coinmonks