Trading 80 Rule

This is because there are reversals of trends in every period. OR low depending on the trade The 80-20 Trading strategy can be used for any period.

Trading The Value Area An Intra Day Strategy For Trading Based By Luke Posey Towards Data Science

You need to look at the amount of PSI that you receive for each individual and how much of that amount comes from one client.

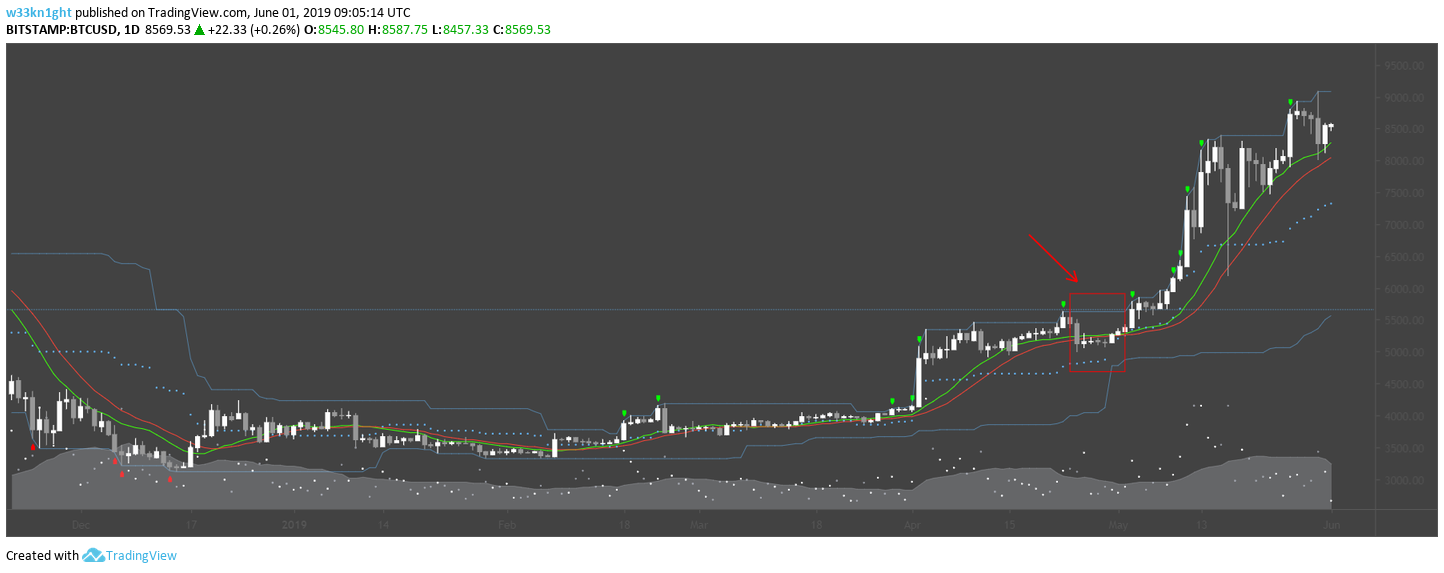

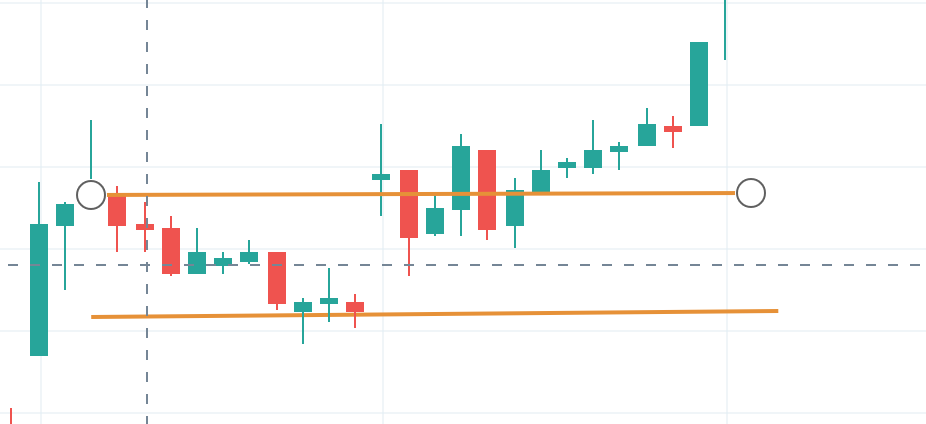

Trading 80 rule. We make financial markets clear for everyone. A futures trading technique which operates under the assumption that if a market opens outside its value area where 70 of the prior sessions volume traded and then trades into value for two consecutive 30 minute periods there is an 80 chance that the market will rotate all the way to the other side of value. The 80 Rule states that when the market opens or moves above or below the value area but then returns to the value area twice for two half-hour periods there is an 80 chance of filling the value area.

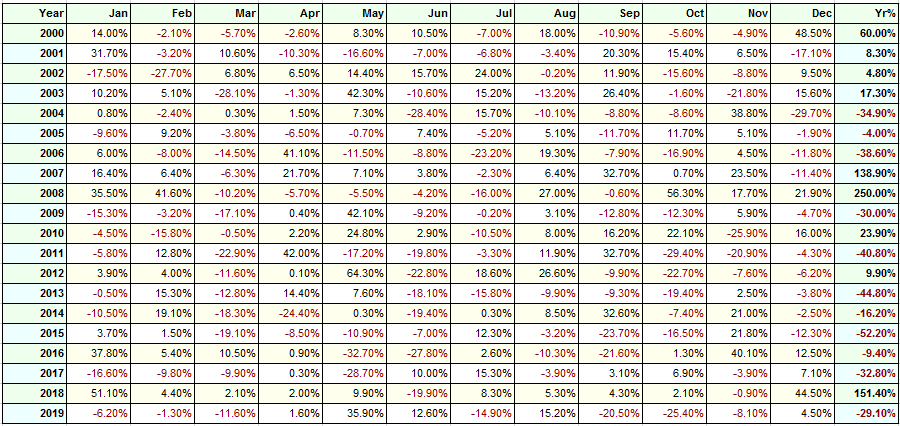

To compound money and not your losses you need to be aware of an insidious probability I call the 5080 Rule. Find the currency pair that is showing a high the last 50 candlesticks. Reread that if it didnt make sense before you move on.

Ad Make your first steps on financial markets. What is the 80 rule. As long as it follows the rules it is a valid trade.

If youre a company partnership or trust and you have more than one individual generating PSI the 80 rule applies to each individual. The 80 Rule. Think about these probabilities for a moment.

The 80 rule asserts that if the stock price opens or move abovebelow the value area but then returns to the value area twice for two half-hour periods then we have an 80 probability of the value area to be filled. We make financial markets clear for everyone. Enjoy 55 assets and free market strategies.

When the market opens above or below the value area and then gets in the value area for two consecutive half-hour periods. 80 of your results will be. Ad Make your first steps on financial markets.

The 80 - 20 rule applies to many other areas of life - including Forex trading and in simple terms the key point to consider is this. If you multiply that by 16 per trade you will end up with a 1280 gain not including compounding. In business a.

The Pareto Principle commonly known as the 8020 Rule is often used in economics statistics and by humorists to describe real life events and observations. If you think you are trading about 80 of the time you need to evaluate your trading habits and make it more in-line with trading only 20 of the time and 80 of the time should be spent observing and keeping your hands in your pockets not trading. 8020 rule for trading.

The market then has an 80 chance of. The rule states that companies should be hiring protected groups at a rate that is at least 80 of that of white men. Dont let this be you remember the 8020 rule ESPECIALLY as it pertains to trading vs.

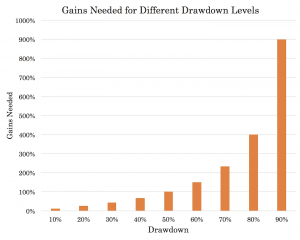

The 80-20 rule also known as the Pareto Principle is an aphorism which asserts that 80 of outcomes or outputs result from 20 of all causes or inputs for any given event. The 80 rule was created to help companies determine if they have been unwittingly discriminatory in their hiring process. Once a secular market leader puts in major top theres a 50 percent chance that it will decline by 80 percentand an 80 percent chance it will decline by 50 percent.

Make a forecast and see the result in 1 minute. Enjoy 55 assets and free market strategies. Then you will have 200 losing trades multiplied by 2 risk or a 400 loss.

For example if a firm has hired 100 white men in their last hiring cycle but only hired 50 women then. You will have 800 winning trades 1000 X 08 and 200 losing trades. This measure is designed to prevent panic selling by stopping trading after a security or an index has fallen by a.

A rule on the New York Stock Exchange mandating that trades stop for a certain amount of time if the Dow Jones Industrial Average falls 10 20 or 30 in a single trading day. Make a forecast and see the result in 1 minute. This can be a swing trade day trade or a scalping trade.

The Pareto principle apply to trading.

Trading Is 80 Waiting Stock Market Quotes Trading Quotes Forex Trading Quotes

Let S Talk About One Of The Most Used Trend Indicators The Rsi 80 20 And How To Trade It Effectively Trading Strategies Rsi Trading

Turtle Trading Rules Does It Still Work Today

/dotdash_Final_Step_Back_From_The_Crowd_and_Trade_Weekly_Patterns_Jun_2020-01-c2cca567559f488889622a34f1d0d487.jpg)

Step Back From The Crowd Trade Weekly Patterns

Maximize Profits With The 80 20 Rule When Day Trading Dttw

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-03-790520a63e6046019dfadf5056d26ed9.jpg)

Intraday Trading Rules Stock Picking Strategies

:max_bytes(150000):strip_icc()/dotdash_INV-final-Filter-Rule-Apr-2021-01-dd165587e69a4439bc8e1cfe3a0ea99b.jpg)

Filter Rule Definition And Example

Day Trading Risk Management And The One Percent Rule

4 Effective Trading Indicators Every Trader Should Know

Trading The Value Area An Intra Day Strategy For Trading Based By Luke Posey Towards Data Science

Martingale Trading Strategy How To Use It Without Going Broke

Top Indicators For A Scalping Trading Strategy Stock Trading Strategies Trading Charts Intraday Trading

What Is The 80 20 Rule The Pareto Principle Explained

The Pareto Principle 80 20 Rule Pareto Principle 80 20 Principle Rules

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-02-4d94d47059144265b9986875e0bcf113.jpg)

Intraday Trading Rules Stock Picking Strategies

Turtle Trading A Market Legend

/dotdash_Final_Step_Back_From_The_Crowd_and_Trade_Weekly_Patterns_Jun_2020-01-c2cca567559f488889622a34f1d0d487.jpg)

Step Back From The Crowd Trade Weekly Patterns