Coinbase W-2

Learn how to connect with eCommerce providers. And do try to get these links and apps on your own through the app stores please do not click on links that are shared by someone in your DMs.

Coinbase Ulasan Tahu Wawasan Coinbase Menangkan Perdagangan Anda Iso

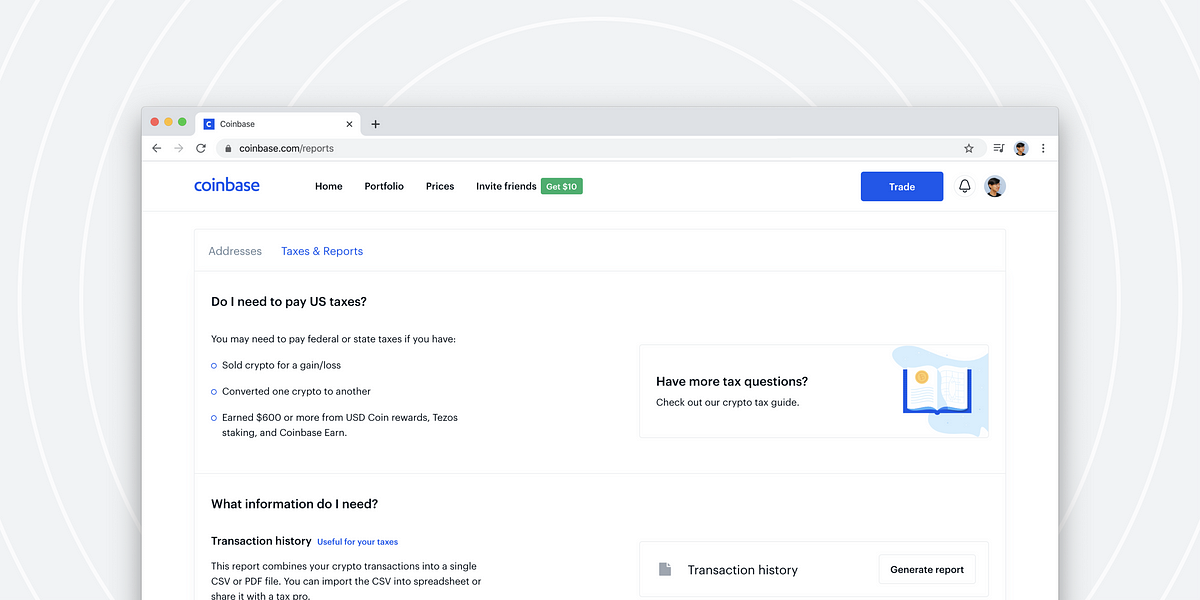

Coinbase reports some of your transaction activity to the IRS if you meet certain criteria.

Coinbase w-2. SI 6 n 10 rIW 5 NUzwp 1 TB 2 P 0 vk 4 YK 4 w 2 aX 5 bkev 4 CBHsp 3 Wwqf 1 l 0 D 1 gkgPTp 0 zQnKaZUoune 7 rmP. Protect yourself against losing access to your Coinbase Wallet. Getting started Identity document verification.

Get in touch with me to help you out. Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties. Recently many Coinbase users are facing issue while trying to login in the application.

Basically Cberrors Error 0 this error message appears on the Coinbase. - You are a Coinbase customer AND - You are a US person for tax purposes AND - You have earned 600 or more in rewards or fees from Coinbase Earn USDC Rewards andor Staking in 2020. Coinbase banned my account after a few years of being a loyal customer and failed to provide a reason why despite me offering to provide W-2 recent pay stubs bank statement etc Circle Why the fuck are these guys even still considered a company after their completely stupid decision to drop BTC.

On Coinbase you can spend fiat to purchase Bitcoin Bitcoin Cash Litecoin Ethereum and Ethereum Classic. Because Coinbase is a payment processor converting bitcoin to USD they do issue Form 1099-K for merchants which have more than 20000 of gross sales and more than 200 transactions in a. The exchange sends two copies of Form 1099-MISC.

Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS. By Loha Leffon Published July 23 2020 Full size is 600 396 pixels. These guys used to be great.

Coinbase will send both you and the IRS a copy of a 1099-MISC if. A Form 1099-K is an IRS form that companies like Coinbase use to report certain financial transactions. Tips and steps for verifying your identity documents with Coinbase.

Coinbase earn and WeNano are both nice legit options for you to earn some crypto worth 40. Protect yourself against using a wrong Wallet. This government form reports the employees annual wages and any taxes withheld and is used for annual tax filing purposes.

Contribute to adamgilmancoinbase-exchange-python development by creating an account on GitHub. Getting started Supported cryptocurrencies. Coinbase is a secure online platform for buying selling transferring and storing cryptocurrency.

Traders who made more than 600 from crypto rewards or staking in the last tax year. Its similar to a W-2 from an employer or a 1099-INT for bank interest except it reports that you received money not necessarily that that money is income. Coinbase Wallet Can I lose access to my Wallet funds.

The W-2 form in the United States. Firstly please use a. One to the taxpayer and one to the IRS.

Coinbase Commerce eCommerce integrations. Used by some crypto exchanges to report transactions for eligible users. Coinbase said in the post it will not issue IRS form 1099-K for the 2020 tax year.

With the recent multiple stories of Bitcoin getting stolen from wallets I am here to let you know there is a way to keep your Bitcoin safe from getting compromised. Employers are required to file a Form W-2 for each employee who earns more than 600 for services performed during the year. Currently Coinbase sends Forms 1099-MISC to US.

For example if you just had W-2 income you wouldnt be required to file this. Contribute to adamgilmancoinbase-exchange-python development by creating an account on GitHub. Just a healthy practice we all should follow to keep ourselves safe.

Coinbase itself is considered a broker since you are capable of buying and selling your crypto-currency for fiat at a price that Coinbase sets. Python interface for Coinbase Exchange. Learn about what happens to unsupported crypto sent to Coinbase and crypto sent to Coinbase on the wrong network.

Coinbase Wallet What happens if I use the wrong Wallet address to send or receive crypto. Its crazy out there. In short yes Coinbase reports to the IRS.

247 live chat How to Read a W-2. W-2 Form Wage and Tax Statement. Thus if you have received a 1099-MISC from Coinbase so has the IRSand.

Prepare 8843 state tax returns FICA. In terms of capital gains these values will be.

Cara Transfer Saldo Coinbase Ke Indodax Youtube

How To Send Bitcoin From Coinbase In 2 Easy Steps One37pm

Apa Yang Dimaksud Dengan Mata Uang Kripto Coinbase

Mack Coinbase Huawei Community

Mint Integrates With Coinbase So You Can Track Bitcoin With The Rest Of Your Finances Venturebeat

Goks Coinbase Dompet Uang Kripto Resmi Melantai Di Bursa

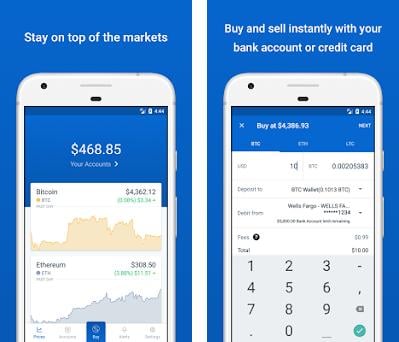

Coinbase Buy Trade Bitcoin Ethereum More Apk Download For Windows Latest Version 9 31 2

Why Is My Eth Not Depositing Coinbase Pro Coinbase Transfer Missing Jeff Monahan

Dogecoin Bakal Dijual Di Coinbase Harga Melonjak 25 Persen

Ceo Coinbase Masuk Lis Orang Terkaya Dunia Karena Kripto

Easily Transfer Crypto From Coinbase Com To Your Coinbase Wallet By Siddharth Coelho Prabhu The Coinbase Blog

8 Pilihan Dompet Bitcoin Terbaik Untuk Aset Digitalmu Glints Blog

Evil Geniuses Partner With Cryptocurrency Exchange Platform Coinbase The Esports Observer

Coinbase Referral Bonus Get 7 Or 10 Of Free Bitcoin After Buy Selling At Least 76 Of Crypto Jake Kuyser

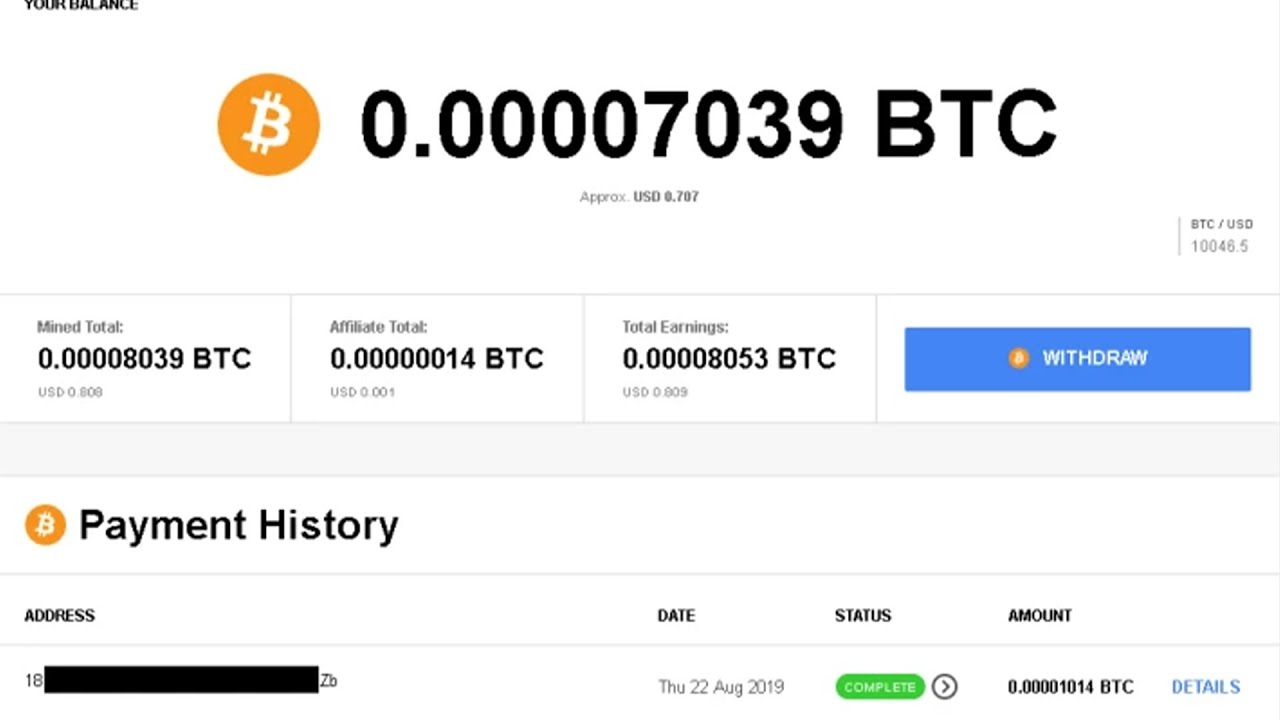

Cryptotab Browser Payment Proof Bitcoin Mining 2020 Coinbase Wallet Youtube

Coinbase To Issue 1099 Misc Removing Major Tax Headache

Melantai Di Wall Street Valuasi Coinbase Tembus Rp1 260 T

Apa Itu Coinbase Platform Belanja Aset Kripto Bitcoin Cs

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog