1099-b Coinbase

Coinbase Issues 1099s. You may receive an IRS B-Notice if there are any discrepancies with your tax identification number TIN and legal name used by Coinbase to file Forms 1099 with the IRS.

3 Steps To Calculate Coinbase Taxes 2021 Updated

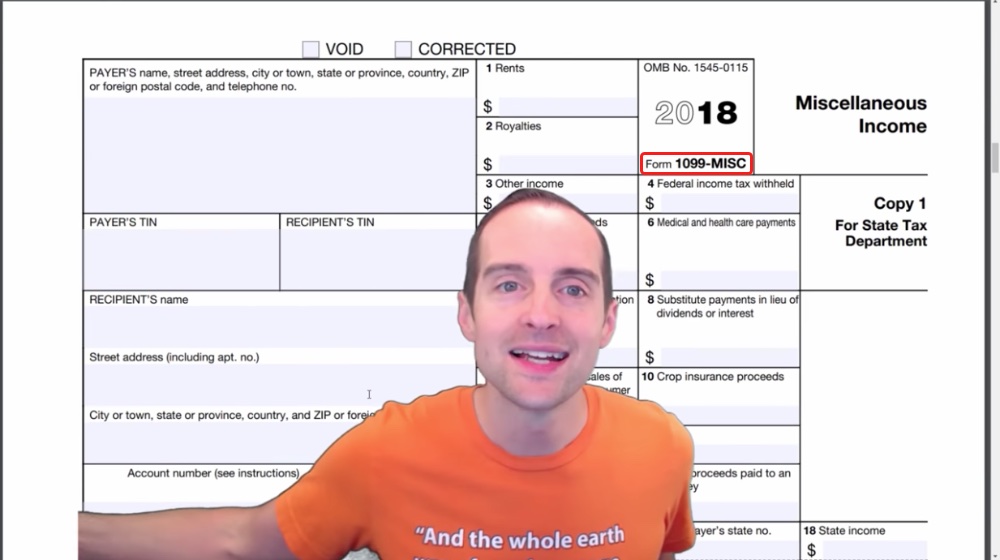

Form 1099-B is traditionally used by brokers and barter exchanges to report gains on a capital asset sold or exchanged on behalf of clients.

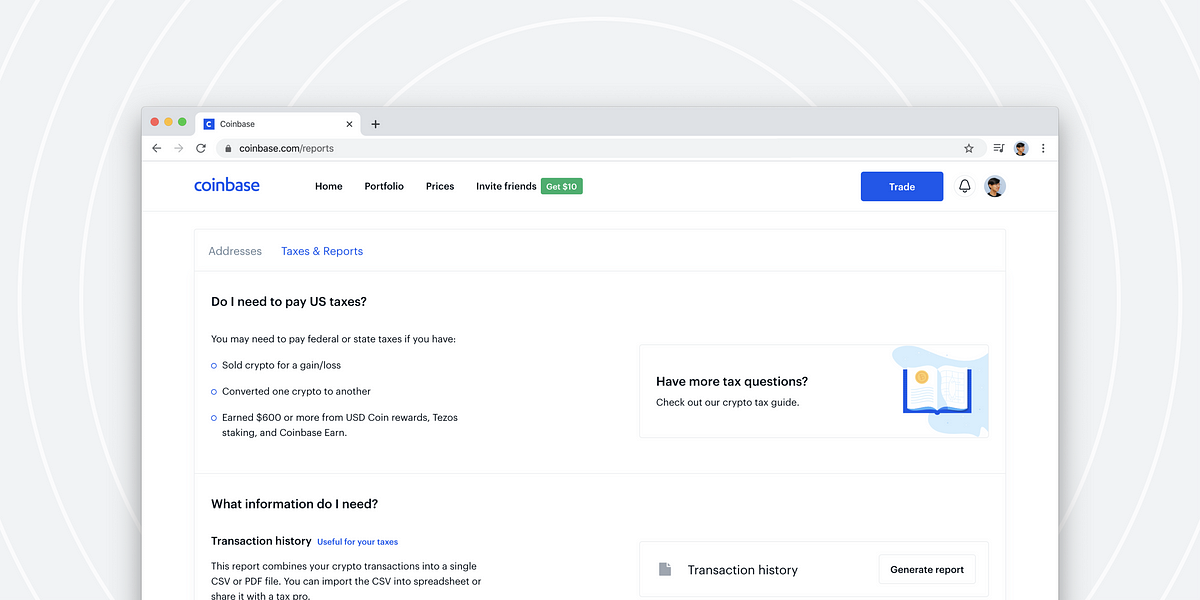

1099-b coinbase. 1099 b coinbase Coinbase Tax Resource Center Coinbase Hel. Coinbase customers can generate reports with all buys sells sends and receives of all crypto associated with their Coinbase and Coinbase Pro accounts. Does Coinbase Send a 1099-B.

Cryptocurrency can be sent to any wallet address and any platform in the world. Transferability is core to the idea cryptocurrency. Reminds Users to Pay Taxes on Bitcoin Gains.

You may receive an IRS B-Notice if there are any discrepancies with your tax identification number TIN and legal name used by Coinbase to file Forms 1099 with the IRS. If you are audited and cant prove the price you paid the IRS is likely to declare the entire amount to be a taxable. Prescribe what information is needed to resolve the B-Notic.

Coinbase is in a tough spot. As a result they are not able to send you a 1099-B like a traditional broker. Nathan Reiff has been writing expert articles and news about financial topics.

Proposing to provide form 1099-B is ideal for customers who never leave the Coinbase environment but it isnt a solution for clients who transact with bitcoin. What a 1099 from Coinbase looks like. Because cryptocurrency exchanges are not currently required to issue 1099-B statements like a stock broker does you will need your own accurate records of your purchases and sales.

But unfortunately Coinbase has advised that it will not be issuing any 1099-Bs at this time. Its very important to note that even if you do not receive a 1099 you are still required to report all of your cryptocurrency income on your taxes. If you receive a Form 1099-B and do not report it the same principles apply.

These reports only detail transactions associated with your Coinbase account and will not be correct if you moved crypto from other wallets or exchanges as Coinbase doesnt have information about your holdings on other. Even if you didnt receive a form your crypto trades must still be reported to the IRS. You might be interested in Bitcoin if you like cryptography distributed peer-to-peer systems or economics.

Coinbases report mimics to some extent what stock investors get from their brokers on Form 1099-B although the company does not send a copy. Prescribe what information is needed to resolve the B-Notice. Bitcoin is a distributed worldwide decentralized digital money.

Yes Coinbase does report your crypto activity to the IRS if you meet certain criteria. The only form they still issue is 1099-MISC probably to streamline their tax services. If you are subject to US taxes and have earned more than 600 on your Coinbase account during the last tax year Coinbase will send you the IRS Form 1099-MISC.

However transferability also makes it difficult for Coinbase and any other exchange to give tax records that include cost basis information original purchase price of an asset. There is no government company or bank in charge of Bitcoin. Not doing so would be considered tax fraud in the eyes of the IRS.

Bitcoins are issued and managed without any central authority whatsoever. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase but you can still generate reports on the platform and then use these for your crypto tax software or to. The gold standard in tax reporting for asset sales would be a Form 1099-B which is what brokerage firms use to report stocks and securities.

This should not be a surprise. Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season. Likewise Coinbase Kraken and other US exchanges do report to the IRS.

Does Coinbase Send a 1099-B. Coinbase is in a tough spot. Unlike Forms 1099-MISC or 1099-K Form 1099-B does report individual transactions detailing the following information.

These forms include the cost basis and sales price and make tax reporting a breeze. With digital currency you can easily transfer your assets anywhere well beyond the purview of Coinbase meaning they may not have vital information like the cost basis original price paid for crypto you sell. The offer seems more like a signal to the IRS that Coinbase is willing to work towards a reasonable solution.

Coinbase has offered to instead prthe IRS with 1099-B information which is a report of every virtual currency transaction leaving Coinbase with a cost basis if required and a taxpayer name and identification number.

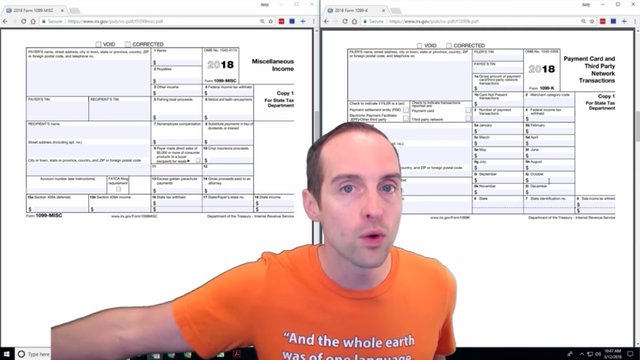

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

How To Do Your Coinbase Taxes 2020 Coinbase Tax Documents Tokentax

2018 Irs Cp2000 For Cryptocurrency Based On 1099 K Form Taxbit Blog

Does Coinbase Report To The Irs Cryptotrader Tax

Does Coinbase Report To The Irs Cryptotrader Tax

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

Coinbase To Issue 1099 Misc Removing Major Tax Headache

Coinbase To Issue 1099 Misc Removing Major Tax Headache

Coinbase Review 2021 Is It The Best Crypto Exchange

What Is A Cryptocurrency 1099 Coinbase 1099 Misc Tokentax

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

Coinbase Ditches Us Customer Tax Form That Set Off False Alarms At Irs

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

What Is A Cryptocurrency 1099 Coinbase 1099 Misc Tokentax

What Is A Cryptocurrency 1099 Coinbase 1099 Misc Tokentax

Does Coinbase Report To The Irs Cryptotrader Tax

3 Steps To Calculate Coinbase Taxes 2021 Updated

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog