Uniswap Background

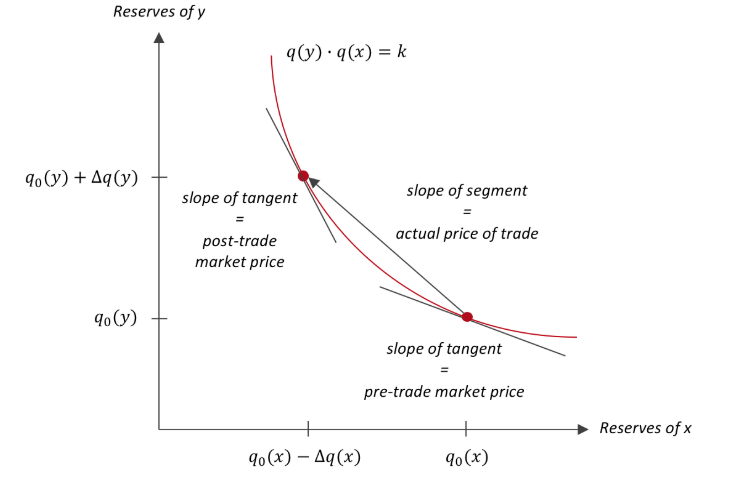

The background of the uniswap platform. Uniswap is the leading example of an automated market maker amm a type of exchange or swap pool where theres no counter party required to trade other than open decentralized liquidity pools.

Mstable Introducing Constant Sum Bonding Curves For Tokenised Assets By Henrik Andersson Cfa Mstable Medium

Mstable Introducing Constant Sum Bonding Curves For Tokenised Assets By Henrik Andersson Cfa Mstable Medium

Then in april 2019 the startup managed to raise 1 million usd in a.

Uniswap background. These amms require no or very low listing fees and their trading volumes can be as high as top exchanges. Sybil maps on chain addresses to digital identities to maintain a list of delegates all while avoiding pesky user signups on chain transactions and manual record keeping. Uniswap is an open source protocol for swapping erc 20 tokens and runs on the ethereum network.

In this regard uniswap is technically a decentralized exchange dex. Today were excited to introduce sybil a governance tool for discovering delegates. Uniswap governance will be live from day one although control over the treasury will be delayed until october 17 2020 1200am utc.

The history of uniswap started when a small uniswap team which included less than 10 employees received a 100000 usd grant from the ethereum foundation and made everything possible to use these funds to the advantage of the platform. Background launched in november of 2018 uniswap was founded by hayden adam a young yet talented developerdesigner who was relatively new to solidity. Uniswap has set the standard for automated liquidity provision.

It consists of a series of smart contracts that allow anyone to directly trade with other users on the ethereum chain. With a 100k grant from the ethereum foundation hayden and his small team of less than 10 were able to build a compelling dex which has garnered significant traction since launch. It is now time to set the benchmark for responsible but radical long term aligned on chain governance systems.

We hope that sybil can grow adoption of uniswaps governance system and encourage both existing and future uniswap delegates to.

How To Buy A Token On Uniswap Exchange By Lithium Medium

How To Buy A Token On Uniswap Exchange By Lithium Medium

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcruisu9fqpf3689w0rdo Hbob1ghjtw1nacccms Ai Usqp Cau

A Background Look At Uniswap And How To Conduct An Ieo Tokenminds Blog

A Background Look At Uniswap And How To Conduct An Ieo Tokenminds Blog

Uniswap Now Also With Own Token Uni Block Builders Net

Uniswap Now Also With Own Token Uni Block Builders Net

Uniswap Uni Token Symbol Defi Project Stock Vector Royalty Free 1825186943

Uniswap Uni Token Symbol Defi Project Stock Vector Royalty Free 1825186943

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcruisu9fqpf3689w0rdo Hbob1ghjtw1nacccms Ai Usqp Cau

Uniswap Birthday Blog V0 V0 Describes Uniswap S Creation V1 By Hayden Adams Uniswap Medium

Uniswap Birthday Blog V0 V0 Describes Uniswap S Creation V1 By Hayden Adams Uniswap Medium

Uniswap Full Guide How To Make Money Yield Farming Asia Crypto Today

Uniswap Full Guide How To Make Money Yield Farming Asia Crypto Today

Uniswap Uni Cryptocurrency Token Symbol Defi Vector Image

Uniswap Uni Cryptocurrency Token Symbol Defi Vector Image

Exchange Series 4 Of 7 Uniswap

Exchange Series 4 Of 7 Uniswap

![]() Uniswap Uni Token Symbol Of The Defi System Shining In The Rays Of Light Cryptocurrency Logo Icon Decentralized Finance Programs Vector Eps10 Stock Vector Image Art Alamy

Uniswap Uni Token Symbol Of The Defi System Shining In The Rays Of Light Cryptocurrency Logo Icon Decentralized Finance Programs Vector Eps10 Stock Vector Image Art Alamy

Purchasing Property With Defi It S Happening Right Now Defi Rate

Purchasing Property With Defi It S Happening Right Now Defi Rate

Uniswap Defizap Liquidity Provider Tutorial Earn Dex Trading Fees

Uniswap Defizap Liquidity Provider Tutorial Earn Dex Trading Fees

Uma Uniswap Listing Launches With A Bang Defi Governance Fundraise

Uma Uniswap Listing Launches With A Bang Defi Governance Fundraise

Uniswap Tvl Nears 3 Billion Makes New Ath At 2 82 Billion Cryptopolitan

Uniswap Tvl Nears 3 Billion Makes New Ath At 2 82 Billion Cryptopolitan

Aave Integrates Uniswap Liquidity Tokens As Lending Collateral

Aave Integrates Uniswap Liquidity Tokens As Lending Collateral

Corionx Uniswap Liquidity Provider Lp Incentive By Corion Foundation Medium

Corionx Uniswap Liquidity Provider Lp Incentive By Corion Foundation Medium

Uma Maker Uniswap Surge Up To 22 What S Causing The Defi Recovery

Uma Maker Uniswap Surge Up To 22 What S Causing The Defi Recovery

Pizza Hot Dogs How Uniswap S Profit Buffet Can Burn Crypto Investors

Pizza Hot Dogs How Uniswap S Profit Buffet Can Burn Crypto Investors

Uniswap Full Guide How To Make Money Yield Farming

Uniswap Full Guide How To Make Money Yield Farming

Uniswap Cryptocurrency Stock Market Name With Logo On Abstract Digital Background Crypto Stock Exchange For News And Media Vector Eps10 Stock Vector Image Art Alamy

Uniswap Cryptocurrency Stock Market Name With Logo On Abstract Digital Background Crypto Stock Exchange For News And Media Vector Eps10 Stock Vector Image Art Alamy

I Choose Uniswap For The Bestdapp

I Choose Uniswap For The Bestdapp

Beginners Guide To Uniswap Dex Swap Stake Earn Rewards

Beginners Guide To Uniswap Dex Swap Stake Earn Rewards

Uniswap Introduces Token Lists For Trusted Dex Trading Defi Rate

Uniswap Introduces Token Lists For Trusted Dex Trading Defi Rate

Sushiswap Pulls Off 800m Uniswap Vampire Scheme

Sushiswap Pulls Off 800m Uniswap Vampire Scheme

How Does Uniswap Work Art Money Provenance

How Does Uniswap Work Art Money Provenance